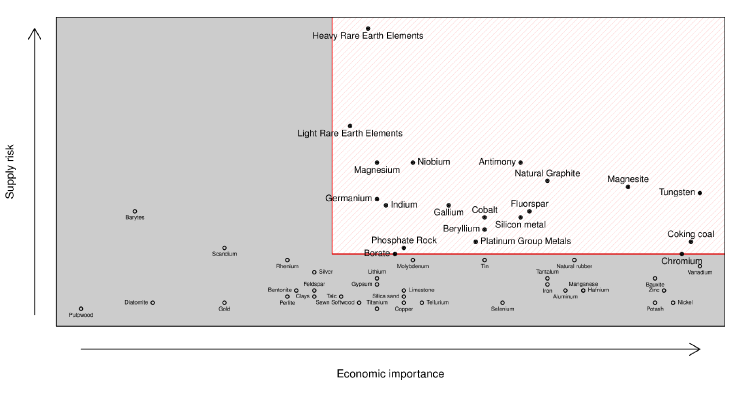

The European Commission has added phosphate rock to the list of 20 Critical Raw Materials, for which supply security is at risk and economic importance is high. Phosphate rock is identified as non-substitutable and of high economic importance. The updated list results from analysis of 54 non-energy, non-food materials including both abiotic and biotic materials. European policies to address raw materials criticality and dependency include improving efficiency of materials use and recycling, waste policy and international cooperation to address supply security.

The raw material included in the EU Critical Raw Materials list is “phosphate rock”, of which Europe has only very limited resources (in Finland) and is largely dependent on imports. The “Profiles” report which supports the designation of the 20 Critical Raw Materials notes that the principal use of phosphate rock is in fertilisers, that demand is expected to increase (because of growing world population and so need for food), and that there are no alternatives in fertilisers or animal feeds.

The report is somewhat unclear in places as to whether it is referring to phosphate rock, phosphoric acid, or processed products (fertilisers, white phosphorus for specific industrial applications). For example, a “supply chain diagram” is presented where phosphate rock is first processed to ‘phosphorus’ and then converted to fertilisers, whereas fertilisers are manufactured from phosphate rock directly and/or phosphoric acid. The ‘Profile’ report states that “Phosphate rock is not recyclable”. This is strictly true, but misleading as the phosphates present in waste streams can of course be recycled, and indeed already are widely recycled through agricultural use of sewage biosolids, manures, other composts and digestates and recycled phosphate products.

Phosphate rock is considered by the EU Commission report to be subject to “high supply risk” because of concentrated production in three main countries (China, Morocco, USA), with high “corporate concentration” in production (small number of producer companies with large market share). World deposits are considered to be widely distributed, with the biggest deposits stated as being in northern Africa, China, the Middle East and the USA. Additionally, there are large seabed deposits, but these are not considered to be economically accessible at present. Despite predicted growth in world demand of 2%, supply is expected by the Commission report to show a large surplus until 2020.

This inclusion of phosphates in the European Critical Raw Materials list will drive development of EU policies to promote sustainable phosphorus management, data gathering on resources and use, R&D and recovery and recycling policies.

European Commission press release “20 critical raw materials - major challenge for EU industry”, 26th May 2014

EU Critical Raw Materials home page: access to Critical Raw Materials profile reports, etc